In today’s competitive real estate landscape, condo assignments are becoming increasingly appealing—especially in hot markets like Toronto. While the concept may seem niche, it offers unique advantages for savvy buyers. Below, we explore why this trend is growing—and how you can navigate it wisely.

1. Faster Access and Lower Competition

Skip the queue – Assignment sales let you step into a pre-construction contract, giving you access to units that are often sold out by the builder.

Buy without the crowd – Since these listings are rarely advertised on MLS, fewer buyers see them. That lower visibility can help you avoid fierce bidding wars.

2. Built-In Equity and Incentives

Get ahead on value – If the market has appreciated since the original contract, you may inherit instant equity when you assign into the deal.

Perks come with it – Some assignments include extended builder incentives, like Tarion warranties or capped development charges.

3. An Exit for Sellers, an Entry for Buyers

Seller escape hatch – Assignments offer a flexible exit without holding nervously for years. Sellers avoid occupancy fees, lengthy closing costs, and market risks.

Buyer opportunity – For buyers, it’s a shortcut to homeownership in a pre-construction market that's often locked down.

4. But Be Aware: Risks Don’t Disappear

No contract negotiation – You inherit the original terms as-is—any restrictions or fees are locked in.

Builder approval required – Assignments often need the builder’s consent—and a fee, which can be substantial.

Complex and costly – Responsibilities like interim occupancy fees, development levies, and legal fees may fall on your shoulders.

Tax implications loom large – Profits from assignments can be taxed at business rates, and HST may apply on top of that.

Final Summary

Condo assignments offer a creative path into the market—fast access, rare inventory, and possible equity gains. But success hinges on understanding the legal complexities, financial obligations, and market timing. With the right team (realtor, lawyer, accountant) by your side, an assignment can be a savvy move—but only if done with care.

Frequently Asked Questions

What is the risk of buying an assignment?

High. Buyers inherit all terms of the original contract—including potential hidden fees. Builders may deny assignments or impose hefty approval fees, and legal/tax obligations are complex.

Is it a good idea to buy a condo in Toronto now?

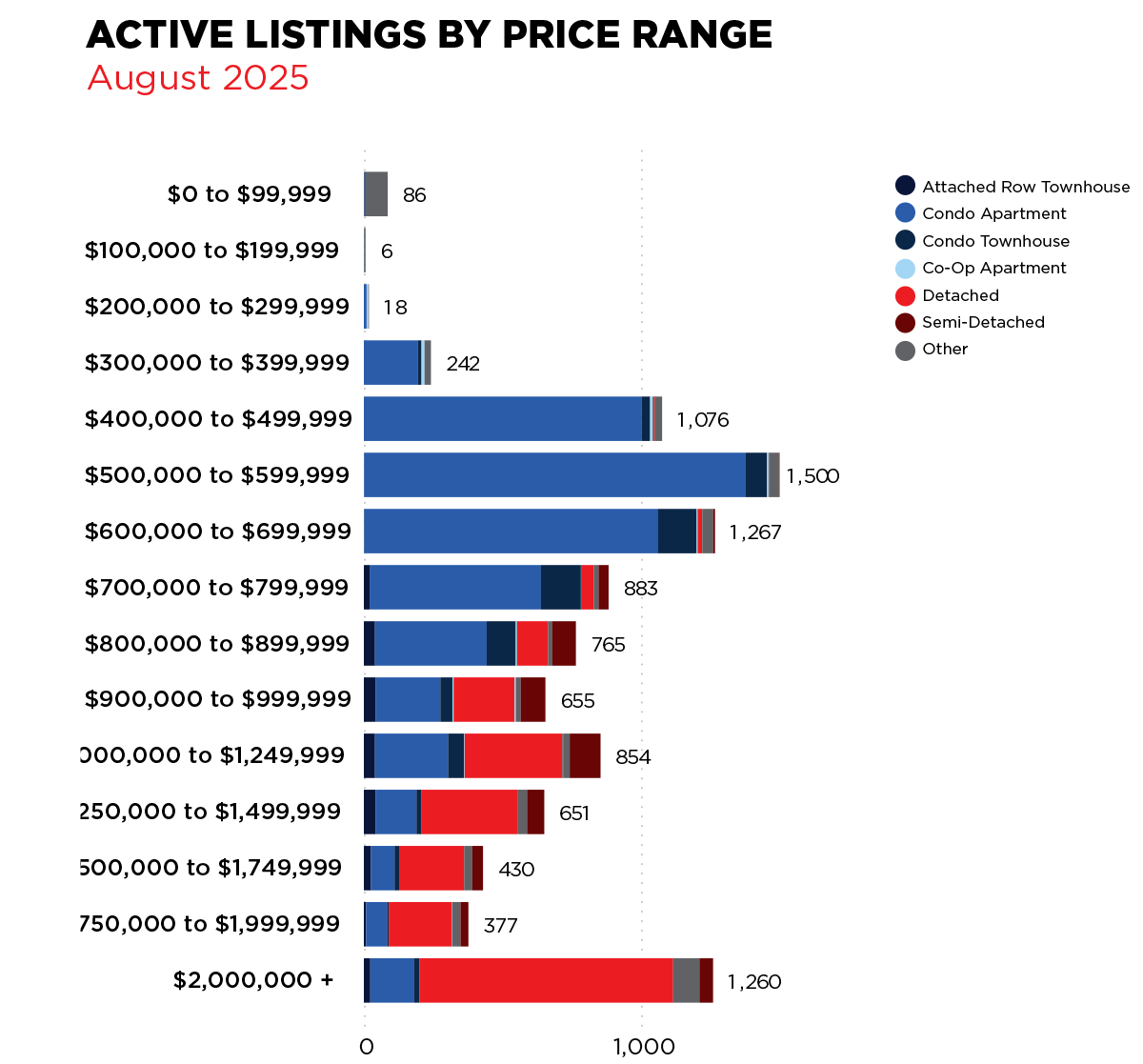

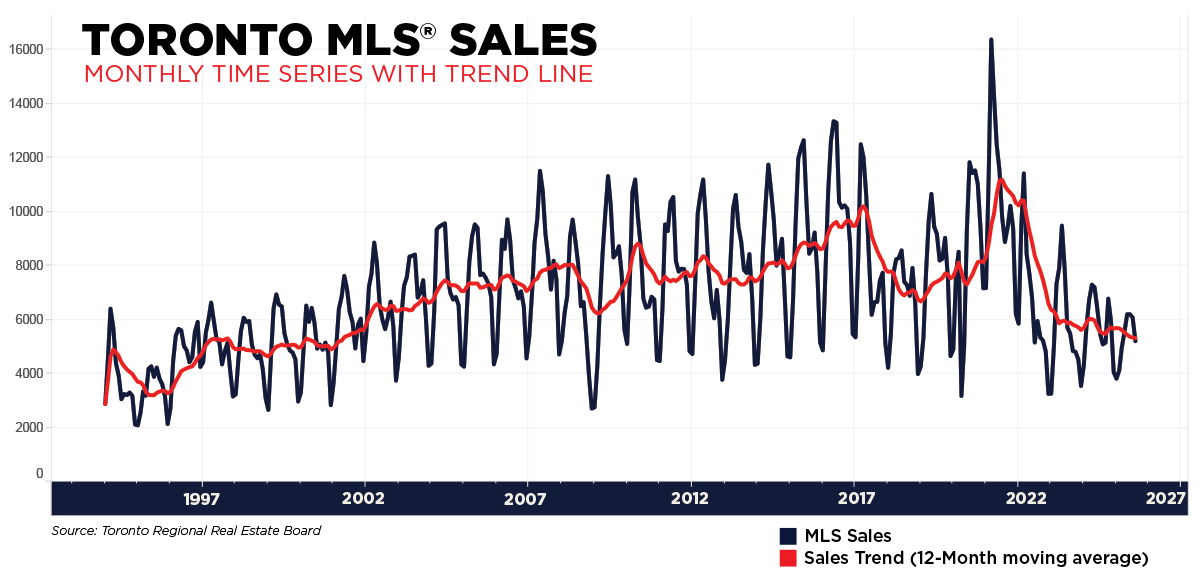

It depends. Toronto’s condo market is facing significant oversupply and price drops—making it a buyers’ market in many areas. If your financing is solid and you’re patient, it may be a strategic time to enter.

How does an assignment sale work in Ontario?

It transfers the original buyer’s purchase agreement to a new buyer, who steps into all rights and obligations of the contract. Builder approval is typically required, and fees or restrictions may apply.

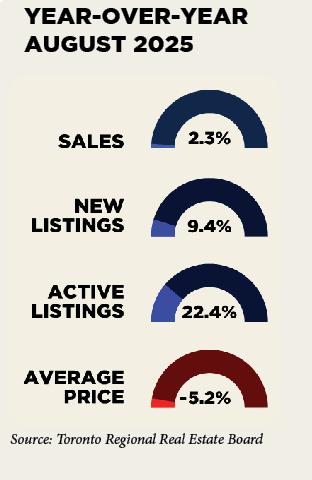

Are condo prices dropping in Toronto?

Yes—GTA condo prices have fallen 5–10% year-over-year; July’s average reached a four-year low of around C$651,000, and inventory remains excessive.

Why are Toronto condos not selling?

The market is oversupplied, driven by investor exits and strata-inflated supply. High interest rates, soft rental demand, and buyer fatigue have all reduced urgency, resulting in longer listing times and price cuts.

.png)