RENTAL MARKET HEATS UP

The standout story of August was the sizzling rental market, with leasing activity around August 1st reaching levels not seen in more than two years. A mix of factors fueled this surge: students preparing for the new school year, announcements from the provincial government and the Big Five banks, and growing expectations that more corporations will follow with supportive measures. This increased demand should give investors more confidence in renting as a viable alternative to selling. If the trend continues, leased rentals could soon outpace new rental listings, with the result being fewer condominiums available for purchase.

“Leasing activity around August 1st reached levels not seen in more than two years”

Source: Habitat in partnership with Proptx

SALES AND LISTINGS ACTIVITY

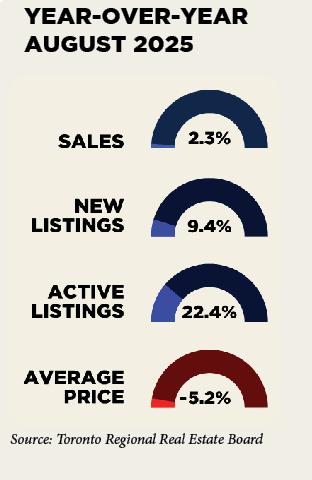

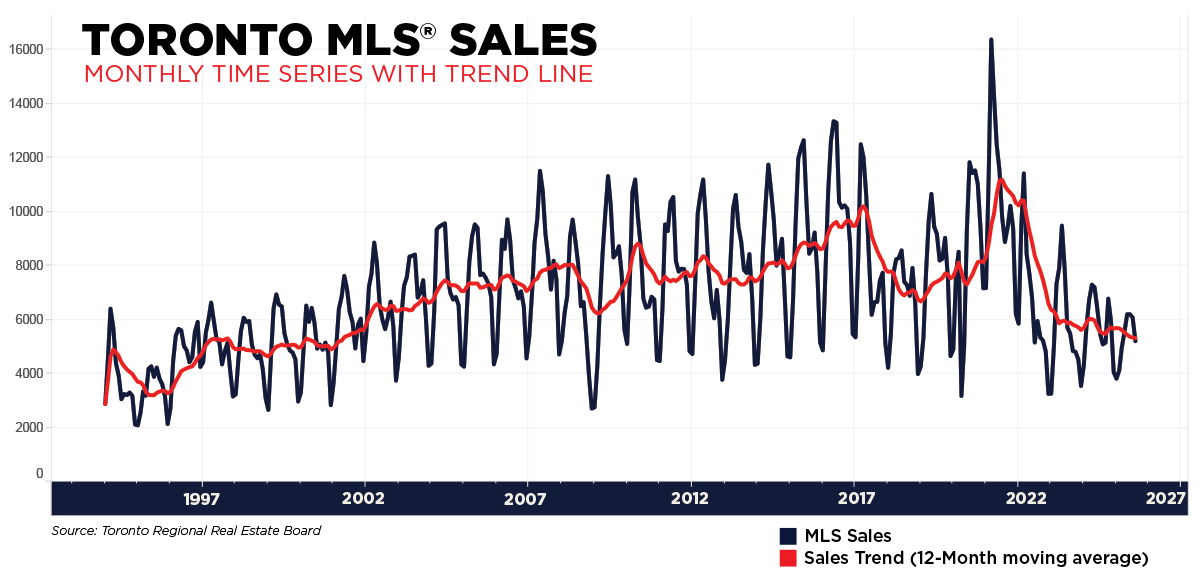

According to the Toronto Regional Real Estate Board (TRREB), GTA REALTORS® reported 5,211 home sales through TRREB’s MLS® System in August 2025—up 2.3% year-over-year. At the same time, 14,038 new listings were added to the system, marking a 9.4% increase compared to August 2024.

The momentum that began in July with cautious buyers beginning to re-enter the market and activity showing positive traction across several segments.

Source: Toronto Regional Real Estate Board

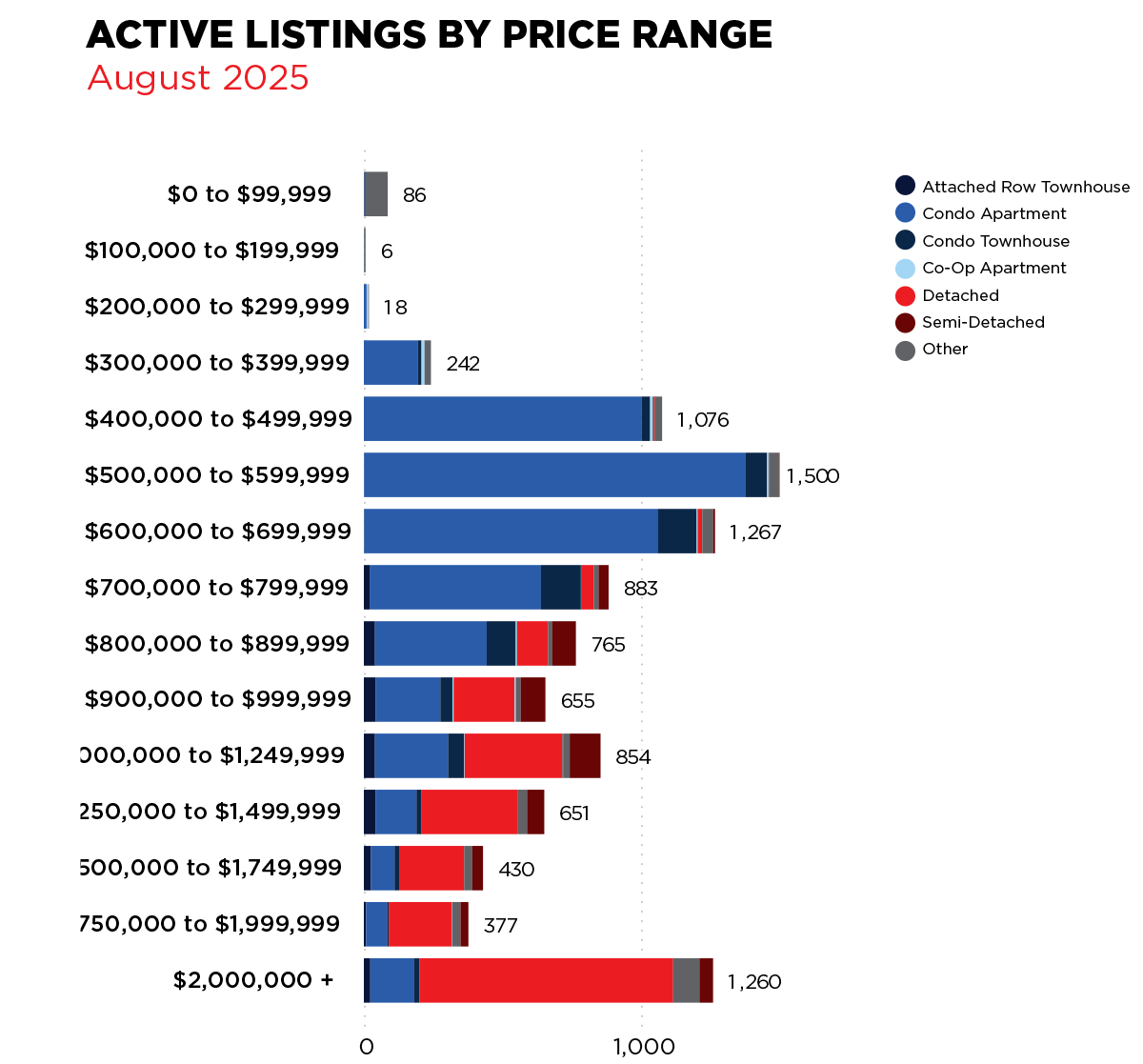

HOT PRICE POINTS

Multiple-offer scenarios were most common at two distinct price ranges:

$800,000 to $1,250,000 particularly in established, high-demand neighbourhoods.

$1,800,000 to $2,100,000 where activity also picked up noticeably.

Pre-approval applications are on the rise, indicating that many buyers are possibly preparing in advance so they can move quickly if the right property becomes available.

CONFIDENCE VS INTEREST RATES

The number one issue impacting today’s real estate market is consumer confidence. Buyers remain nervous and cautious, preferring a “wait-and-see” approach until they gain a clearer sense of economic stability.

Contrary to common belief, it isn’t just interest rates holding back demand—it’s confidence. That said, recent reports showing slower economic growth and unfavorable employment numbers have increased the probability of an interest rate cut in September. Should borrowing costs ease, more buyers are expected to return from the sidelines to the market, eager to take advantage of current inventory levels.

PROPERTY TRENDS

Turnkey homes—modern, move-in-ready properties—are selling quickly.

Homes that are dated or located in oversupplied neighbourhoods continue to sit on the market longer.

Sellers are being forced to adjust, focusing on smart pricing strategies and staging their homes to attract attention.

NEGOTIATION LANDSCAPE

Today’s market has given buyers more leverage. Even in multiple-offer situations, it is possible to win with a conditional offer—a significant shift from the competitive dynamics of recent years. However, some buyers are misreading their opportunities, failing to fully recognize the advantages this market presents.

For sellers, the message is clear: success depends on smart pricing, strong presentation, and an understanding that performance varies widely by neighbourhood and property type.

.png)