Mohammad Khan’s two preconstruction homes have been up for sale on the private market for six months. The properties, both nearing completion, are detached houses in a new development in Oakville, an affluent Toronto suburb where many of the city’s downtown office crowd live.

According to confidential listings viewed by The Globe and Mail, one house is listed for 12 per cent below the $2.56-million price Mr. Khan agreed to pay the developer in 2022 – a discount of just over $300,000. The second one is listed 6.5 per cent above his $2.5-million purchase price.

About a month ago,Mr. Khan received a verbal offer for one of the properties that was $650,000 below the original value, according to his realtor, which he didn’t accept. Since then, no one has shown any interest in buying the rights to his sales contract.

With the developer, Caivan Communities, expected to finish construction this summer, Mr. Khanwill soon have to secure mortgages and take possession of the properties. He worries he can no longer afford to close on the deals – which would put him at risk oflosing his $700,000 in deposits. (Caivan did not respond to a request for comment.)

“My concern is, you know, what about my hard-earned money that I have put down for two homes?” Mr. Khan said. “I’m really worried now about what’s going to happen.”

Many preconstruction buyers across Ontario are in a similar predicament, especially those who bought between 2020 and 2022 when the real estate market was booming and preconstruction homes were selling at much higher prices.

In the past they could have negotiated a private sale – known as an assignment sale – before taking possession and closing on the properties. But that market is gone now as demand for new construction homes is drying up because homebuyers and investors can find cheaper homes on the resale market.

The assignment market gives preconstruction buyers – with a developer’s approval – a way to sell unfinished properties in private deals brokered by real estate agents. It used to be a thriving market where buyers turned an easy profit as home prices soared, and was often used as part of an investment strategy to flip homes before buyers were required to close on properties.

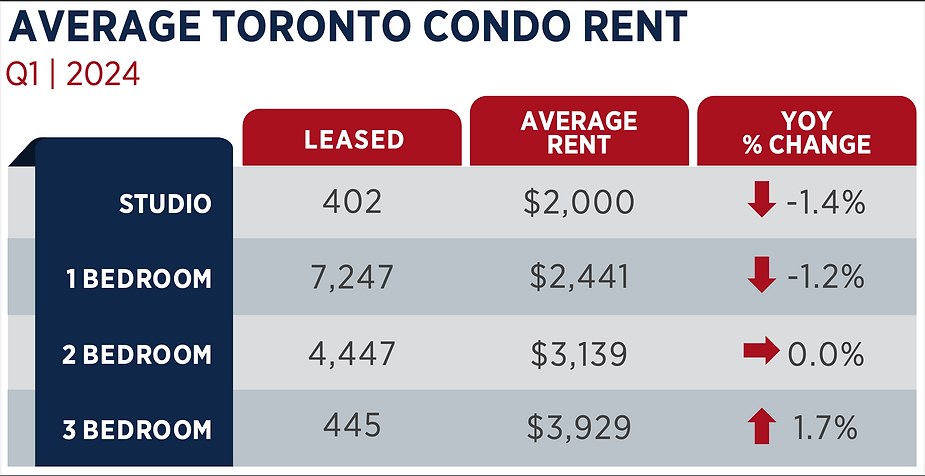

But while preconstruction homes are flooding the markets, buyers can no longer find people willing to take over their purchase contracts, and many can’t afford to cover occupancy fees or carry the mortgages if the sales close.

“Alarm bells are ringing,” said Jeff Carr, a realtor with Re/Max Plus City Team Inc., who said his brokerage has received calls from hundreds of preconstruction buyers inquiring about getting out of their purchase agreements. “A lot of people went into it blindly. There were a lot of agents out there that didn’t properly explain to purchasers what they were actually getting themselves into.”

He added: “I think for a long time, the market was so hot, and it honestly was quick and easy to sell assignments with a significant amount of profit that people just thought that train was going to continue to roll along.”

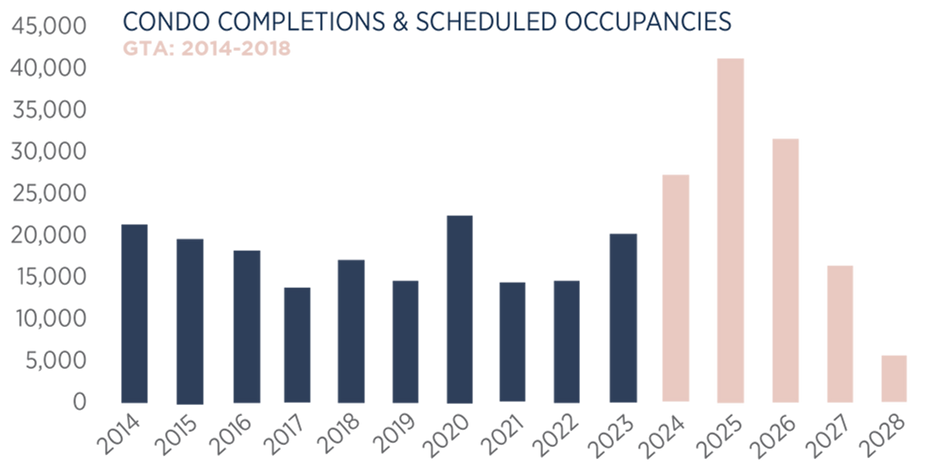

The situation is set to worsen this year with developers on track to finish building thousands of preconstruction homes in Ontario.

Even if buyers are willing to pay a premium for a brand new property, they face more hurdles with an assignment sale. That includes not being able to view the property in person because it is still under construction; additional fees such as the development levies and occupancy charges, which include the interest on the unpaid balance of the purchase price; and the fact that appraisers say the preconstruction prices of the pandemic years are typically 10 per cent to 30 per cent higher than today’s value.

“Why would a buyer come onto the assignment market if they can get the same on the resale market?” said Labeed Butter, a realtor who specializes in assignment sales under his company Assignment Pros. “Even though they are willing to lose their entries deposit, their properties are not selling because they are above market value,” he said.

Preconstruction sellers are not just at risk of losing their entire deposit, but also may have to pay more ifassignment buyers are not willing to pay anywhere close to the original price. It is up to the seller to pay the developer the difference between the original and assignment sale prices.

Ari Zadegan, who has worked on assignment sales for about 17 years, said this is occurring more frequently. Recently, her real estate firm TheZadegan Group sold a client’s preconstruction condo contract for 16 per cent less than the $886,000 original price. The client lost her $177,000 deposit and had to pay an extra $33,000 as she missed the closing date by two months because she was looking for a buyer for her contract.

Ms. Zadegan said the current downturn is longer than previous real estate slumps in 2017 and 2008 with price gaps now in the hundreds of thousands of dollars instead of tens of thousands.

Mr. Khan’s properties are privately listed with Ms. Zadegan. After six months and no real offers, Ms. Zadegan is hoping for some kind of compassionate resolution with the developer.

“We recognize that everyone is going through this pain. The builders did not expect this. The buyers did not expect this,” she said. “You’ve got to understand we are in unprecedented times.”

.png)